- In recent days, Caesars Entertainment reported higher quarterly revenue and reduced net losses year-over-year, while multiple analysts reiterated positive ratings despite mixed sentiment.

- This comes at a time when analysts have raised concerns about emerging softness in the Las Vegas leisure market, even in the face of digital segment growth.

- To assess the impact of analyst concerns about Las Vegas demand, we’ll explore how these factors may influence Caesars Entertainment’s investment outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Caesars Entertainment Investment Narrative Recap

To be a shareholder in Caesars Entertainment, you need to believe in its ability to grow both physical and digital gaming while navigating challenges in Las Vegas hospitality. The latest news, rising revenue and narrower net losses, reinforces confidence in the company’s digital growth, but short-term sentiment will hinge on whether softness in Vegas leisure demand worsens; so far, the impact does not appear to materially alter the biggest risk to the business. Caesars’ digital segment showed robust expansion, highlighted by the recent launch of proprietary online casino titles and expanded poker series, underscoring management’s aim to offset pressure from less predictable in-person volumes. On the other hand, investors should be aware that growing reliance on the Las Vegas leisure market comes with specific risks that could affect long-term returns if preferences among key customer groups continue shifting…

Read the full narrative on Caesars Entertainment (it’s free!)

Caesars Entertainment’s outlook projects $12.6 billion in revenue and $540.9 million in earnings by 2028. This requires a 3.4% annual revenue growth rate and an earnings increase of $735.9 million from the current earnings of -$195.0 million.

Uncover how Caesars Entertainment’s forecasts yield a $40.12 fair value, a 87% upside to its current price.

Exploring Other Perspectives

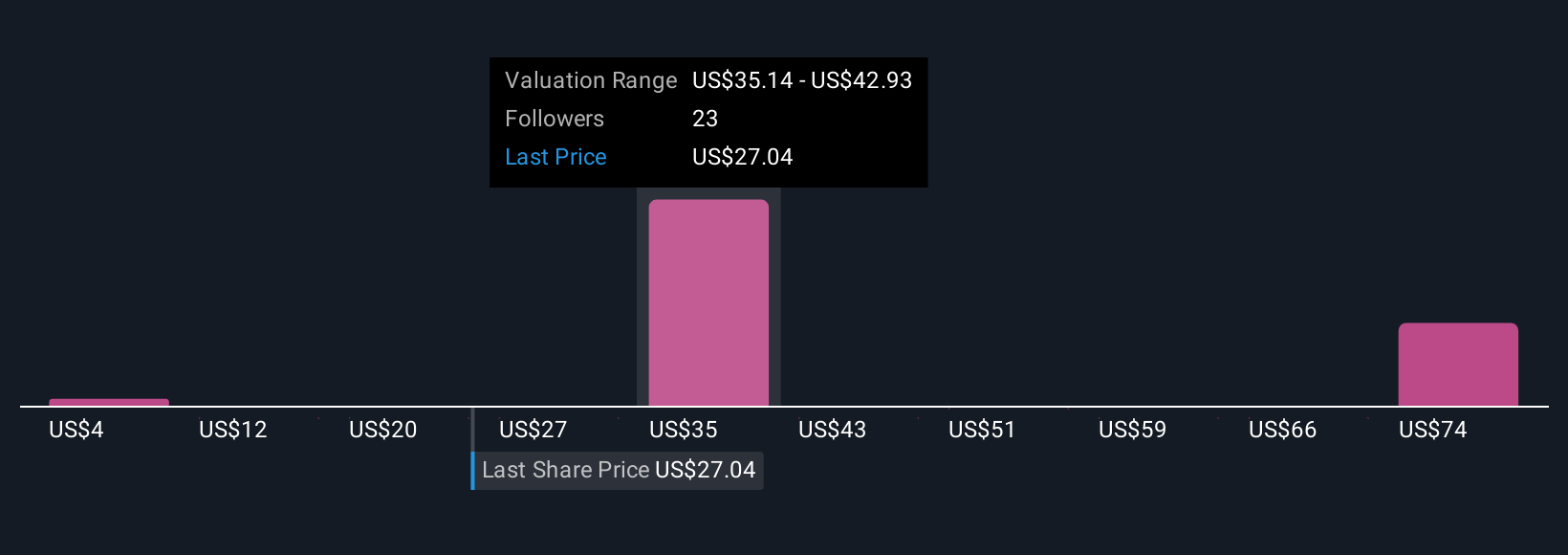

Simply Wall St Community estimates for fair value range widely, from US$4 to US$56.67 across four submitted views. This diversity contrasts with ongoing analyst concerns about softening Las Vegas trends, which could reshape expectations for Caesars’ future earnings strength.

Explore 4 other fair value estimates on Caesars Entertainment – why the stock might be worth over 2x more than the current price!

Build Your Own Caesars Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caesars Entertainment research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Caesars Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Caesars Entertainment’s overall financial health at a glance.

No Opportunity In Caesars Entertainment?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]