It’s easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market – but in the process, they risk under-performance. Investors in BOK Financial Corporation (NASDAQ:BOKF) have tasted that bitter downside in the last year, as the share price dropped 29%. That’s disappointing when you consider the market returned 15%. On the other hand, the stock is actually up 6.8% over three years. The falls have accelerated recently, with the share price down 11% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

On a more encouraging note the company has added US$237m to its market cap in just the last 7 days, so let’s see if we can determine what’s driven the one-year loss for shareholders.

Check out our latest analysis for BOK Financial

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the BOK Financial share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. So it’s well worth checking out some other metrics, too.

BOK Financial’s revenue is actually up 18% over the last year. Since the fundamental metrics don’t readily explain the share price drop, there might be an opportunity if the market has overreacted.

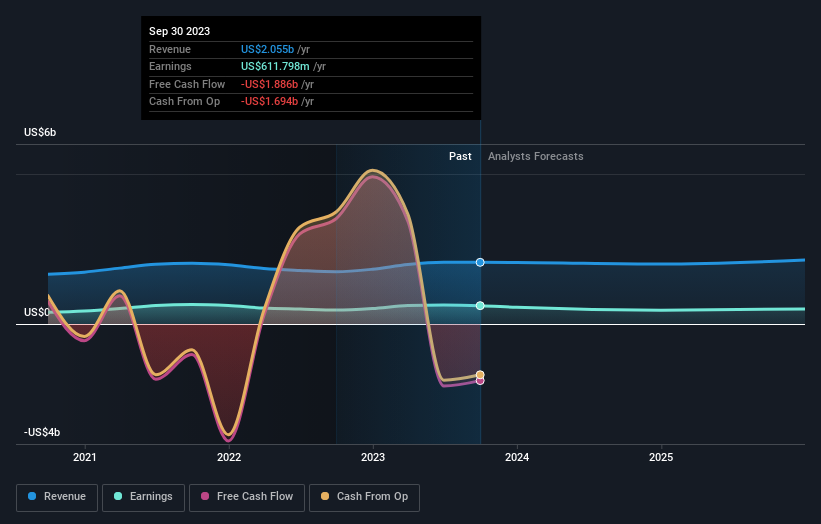

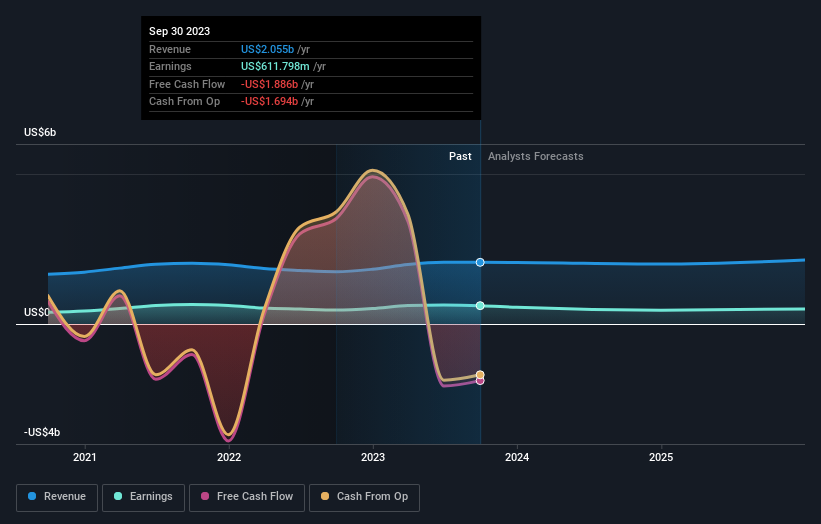

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

BOK Financial shareholders are down 27% for the year (even including dividends), but the market itself is up 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 0.4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that BOK Financial is showing 1 warning sign in our investment analysis , you should know about…

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.